Trade Compliance Features | 24/7 Compliance Monitoring

Schedule Monitoring

Quickcode will continually monitor your product database for any changes to the HTSUS Schedule and will notify you any time there are schedule changes. Quickcode will automatically assess your products and alert you when any code changes affect you, and will also check your existing product codes when you initially bring your products into Quickcode, to ensure you are always up-to-date!

DID YOU KNOW?

CBP issues, on average, 12 revisions to the HTSUS every single year. These revisions include issuing new codes, discontinuing existing codes, tariff changes, identification of additional tariffs, changes to official notes and interpretations.

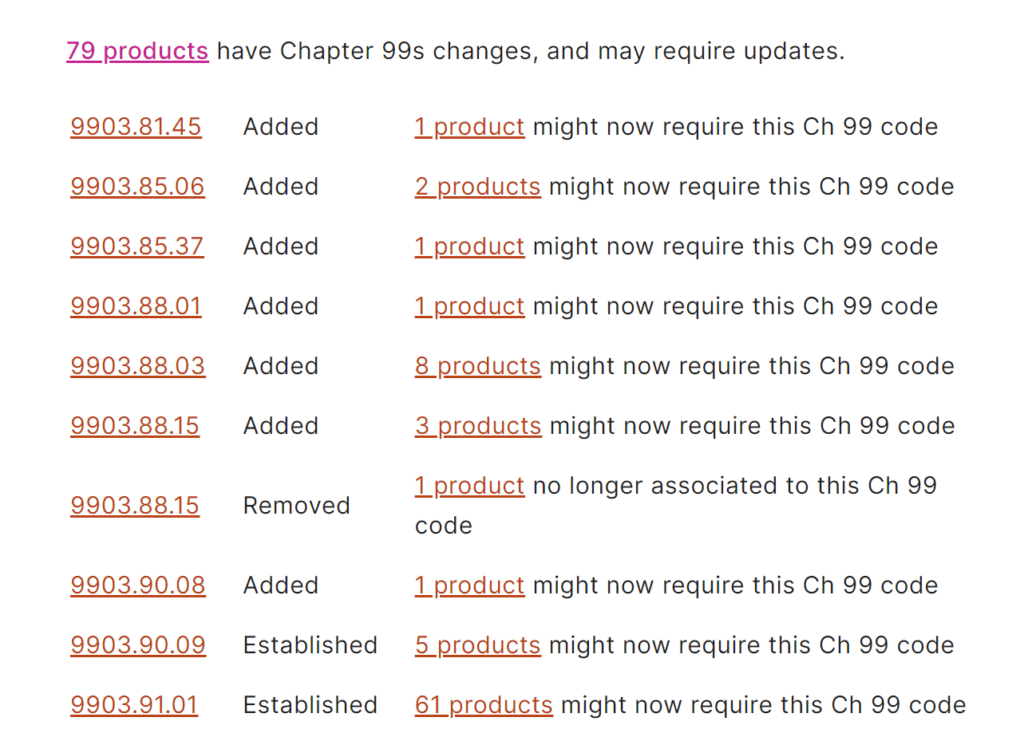

Ch 99 Monitoring

Regulations are constantly changing and Quickcode will keep your products compliant with changes to the Ch. 99 regulations. With each schedule update Quickcode will send a notification alerting you to any changes to your existing products in regards to Ch. 99.

GOT CHINA TARIFFS?

The Trump and Biden administrations have made multiple updates (generally increasing) tariffs for goods imported from China. These are implemented via Ch 99 codes, which Quickcode can help you monitor for changes.

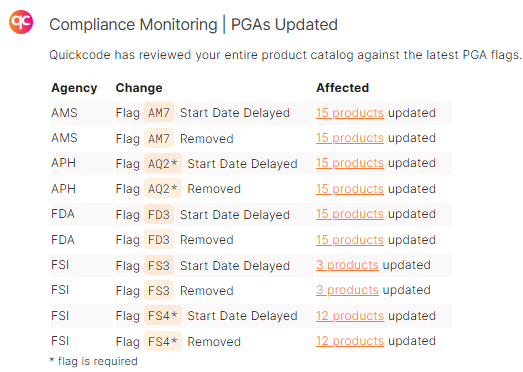

PGA Monitoring

Quickcode will help you navigate the complex Partner Government Agency (PGA) requirements that you will come up against so there are no surprises when you are filing your entry. When new products are brought into Quickcode we will alert you to any potential PGAs that may need to be contacted, and we will also continually update your product database and notify you as PGA requirements change.

AD/CVD Monitoring

Avoid unexpected costs with Quickcode’s AD/CVD Monitoring which will alert you to possible anti-dumping and countervailing cases when you bring your product database into Quickcode. You will also receive alerts any time new cases are added that might affect any of your existing products.

IT’S NOT FAIR!

In order to protect again unfair trading practices and level the playing field for U. S. companies, CBP collects Antidumping and Countervailing Duties (AD/CVD) on imported merchandise that the Department of Commerce finds was sold in the U.S. at an unfairly low or subsidized price.

Why Quickcode?

Choosing Quickcode means partnering with a solution designed to meet the demands of modern supply chain management. Our robust, AI-driven platform ensures your product catalog is always compliant, allowing you to operate with confidence and efficiency.